Increase the value of partially owned and leased retail assets with innovative investment, location, and year on year appreciation.

In business, fractional ownership is a percentage share of an expensive asset. Shares are sold to individual owners. Typically, a company manages the revenue model of the asset on behalf of the owners, who pay monthly/annual fees for the management use fees.

Fractional ownership simply means the division of any asset into portions or shares. If the “asset” is a property, the title or deed can be legally divided into shares. In certain instances this is done by creating a “mezzanine structure”, i.e., creating a company which owns the property then allowing multiple owners or investors to own shares in the company. Those shares can then be purchased and owned by more than one individual. The reasons for a “mezzanine structure” can vary. Two common reasons are to allow transfer of shares without the need to reflect changes on the title or deed to the property, and for tax benefits

We trigger buy, build, occupy and invest in a variety of assets including industrial, commercial, retail, licenced Mines, Warehousing & Logistics. The business of art is another area that’s being transformed by fractional ownership.

Non-traditional forms of real estate assets from data centers to Production assembly lines and furnished commercial retail spaces which are already leased or OEM to big Brands have become increasingly popular.

Get access to the compelling demographics and demand drivers associated with these new sectors, while enhancing returns and diversifying your portfolio.

Optimize your real estate footprint with a location strategy along assured rentals that matches your growth plans with as good as least ticket size of Rs.25 lacs per slot.

| Minimum Slot Amount | 25,00,000/- |

| Slot Area | 500 SQF Fully Furnished |

| Monthly Rental | 30000/- |

| Lock-in Period | 3 years |

| Yearly Increment | 6% on Slot value |

| Property Location | Kochi-Commercial |

| Total Asset Value | 27 Cr |

| No.Of Slots | 36 |

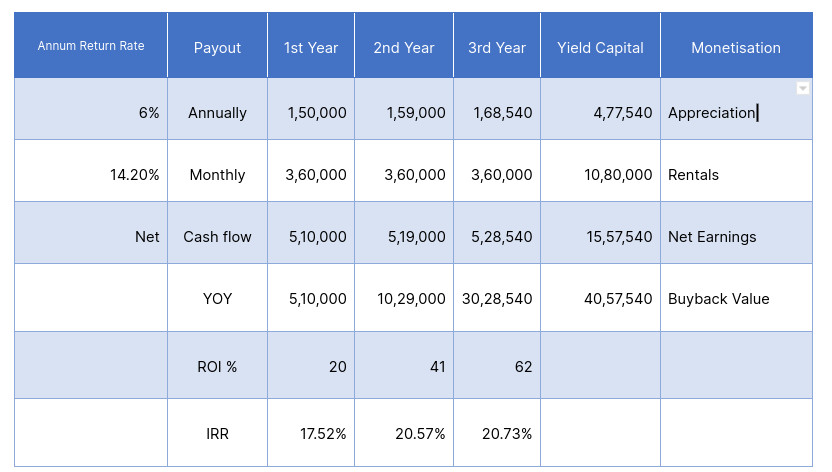

| Annum Return Rate | Payout | 1st Year | 2nd Year | 3rd Year | Yield Capital | Monetisation |

|---|---|---|---|---|---|---|

| 6% | Annually | 1,50,000 | 1,59,000 | 1,68,540 | 4,77,540 | Appreciation |

| 14.20% | Monthly | 3,60,000 | 3,60,000 | 3,60,000 | 10,80,000 | Rentals |

| Net | Cash flow | 5,10,000 | 5,19,000 | 5,28,540 | 15,57,540 | Net Earnings |

| YOY | 5,10,000 | 10,29,000 | 30,28,540 | 40,57,540 | Buyback Value | |

| ROI % | 20 | 41 | 62 | |||

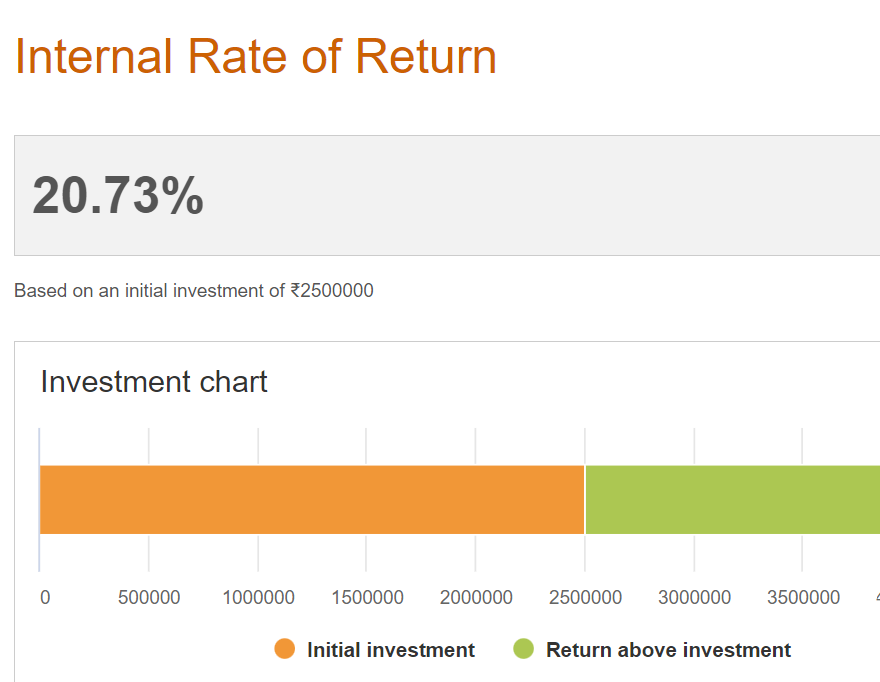

| IRR | 17.52% | 20.57% | 20.73% |

When compared to alternative investment strategies, purchasing pre-leased commercial or retail space has a number of advantages

Fractional ownership, co-ownership, and shared ownership can describe any arrangement where two or more people share ownership of something, whether or not they share usage.

Fractional ownership seems to be emerging as the one most commonly used for time-based sharing of vacation real estate in the U.S., but co-ownership and shared ownership are often used to describe these arrangements in other English-speaking countries.

The fact that an arrangement is described using one of these terms rather than another can be attributed to the seller’s personal taste and the location of the project, rather than two the project type or characteristics.

REIT vs Fractional Ownership of Property: Which one is better for investment?

Fractional property and REITs both work differently and give investors different benefits

Investing in real estate entails an obligation that a person can’t afford on his own. Most people opt for loans to invest in commercial and residential properties because they know that it’s one of the best ways to secure their financial future.

Compared to residential properties that buyers may use for themselves or for letting on rent, commercial real estate (CRE) properties generally require a lot of investment upfront. The CRE properties have prospects to generate higher income than residential properties.

But out of the two investment options, which one is better for the investment?

Both Fractional Ownership and REITs allow investors to procure premium commercial properties and gain monetary benefits generated by monthly rental income, therefore helping them to secure the long-term wealth. However, they operate differently.

Three years later there are now three popular REITS – Mindspace REIT, Brookfield REIT and Embassy REIT. REITs as an investment option have gained significant popularity among institutions & retail investors. These three REITs cover 87 million sq. ft. of commercial real estate assets– Mindspace 31 million sq. ft, Embassy 42 million sq. ft. and Brookfield 14 million sq. ft.

“It is estimated that over the next three years, the fractional ownership market’s worth will reach five billion dollars. This is a shot in the arm for the real estate industry,” – Shiv Parekh, the founder, Hbits.

According to data compiled by hBits (fractional ownership realty firm) fractional ownership has seen a surge over the last five years with an estimated total transaction of Rs 750 crore. Out of this, Rs 350 crore worth of transactions took place in 2020, i.e., after the first Covid lockdown was imposed.

WhatsApp us